(17) The Indications You Should Be Building a DiGA for Today.

Last year, mental health focused DiGAs made over 40,000,000 € in revenue. That is 1,200,000 € after tax, per application. This money comes from somewhere around 187,000 total redemed codes for the 27 digital therapeutics in the space. Seems like an interesting market, eh? So lets break down which indications do and don't make sense to build (or invest into) DiGAs for.

DiGAs (Digital Gesundheitsanwendungen) are digital therapeutics that can be prescribed by doctors and psychotherapists in Germany. They have been on the market for almost 5 years by this point and currently there are 59 different ones accross the whole spectrum of disorders.

27 of them are Mental Health DiGAs. They can be prescribed by doctors and psychotherapists and are reimbursed by statutory health insurances (SHIs).

I have three main questions for today:

- Which indications have the strongest competition?

- What share of all indications for mental disorders are even viable as markets for DiGAs?

- If I were to build a DiGA today, which indication should I start with?

And here are the short answers:

- Affective Disorders.

- Even indications with a 12-month prevalence below 1%.

- Chronic pain management.

For the interested, below are the long answers:

Haven't been offered a DiGA by a doctor yet?

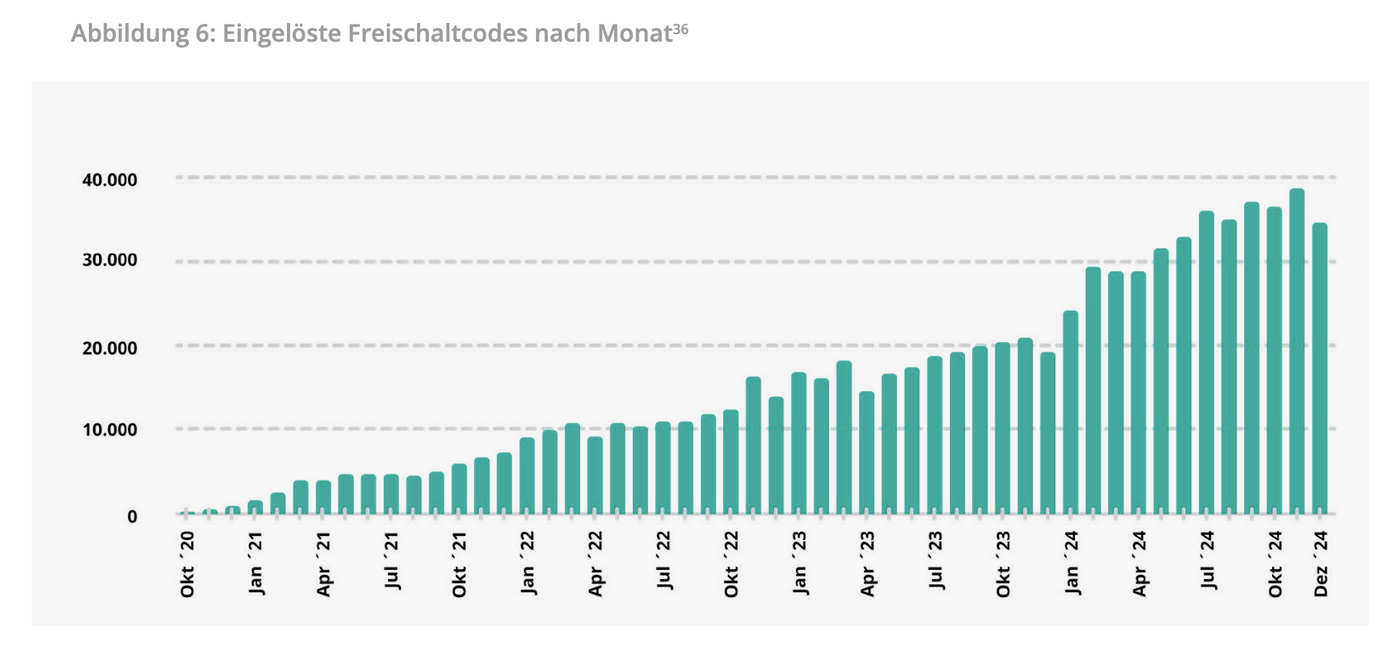

Until end of 2024, roughly 870,000 DiGA-codes have been activated. At this point, well over a 1,000,000 codes have been redemed. Growth has been steady since DiGAs were introduced in 2020, and is still in the high double digits.

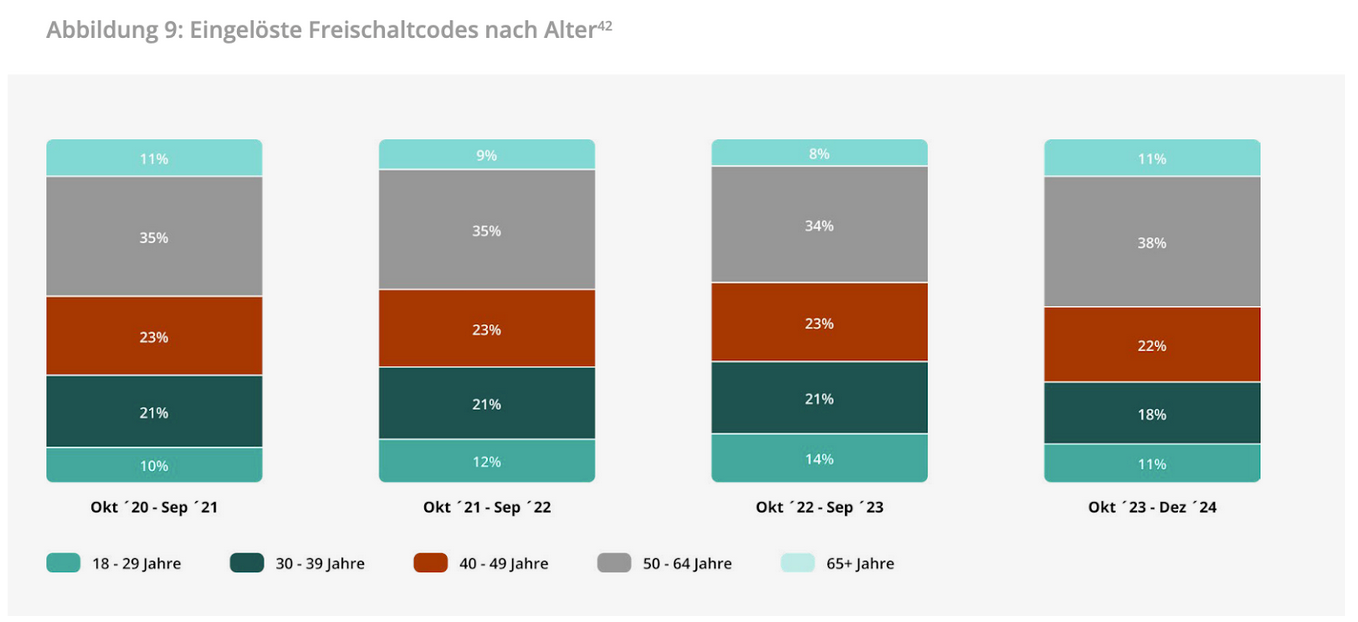

What is surprising is the fact that adoption is strong amongst the older generations:

This might be explained by the large share of DiGAs for cardiac diseases and other chronic issues becoming prevalent in later life. Still, technology can clearly reach most generations.

Mental Health has the biggest share in DiGAs with 27 out of 71 listed in total.

Why is that? I would argue that it is one of the areas of healthcare where bridging solutions are needed most. Immediate access to Psychotherapy is basically out of the question and many patients don't want to receive purely pharmaceutical treatment. So it might be more appealing to patients to "give it a try" whilst they are waiting for full treatment. And doctors might be more inclined to prescribe DiGAs as a less severe yet still effective first measure in treating mental health issues quickly.

But wait: It sucks to build a DiGA.

Regulation makes new DiGAs really expensive. Whilst you do not need extensive evidence of positive treatment effects of your DiGA to get the first customers, you need to fulfill a host of standards and norms. This increases development cost by the order of hundreds of thousands of Euros.

Time to market is horrendous. You are looking at up to 2 years from start of development to preliminary listing in the DiGA registry. Together with the regulatory hurdles and the labor cost associated, there is no way of bootstrapping such a product.

A significant share of doctors don't prescribe DiGAs yet. Companys sell their products to doctors individually, or try to use insurances as distribution partners. In either case, you probably need some form of evidence of efficacy to get into those conversations, so add to the bill a nice multi-month clinical trial to even have a chance for your Marketing team to sell anyone on prescribing your product.

All of this might be reasons why there were almost no new DiGAs accepted in 2024 into the registry. All of this begs the question:

Can a DiGA be good business?

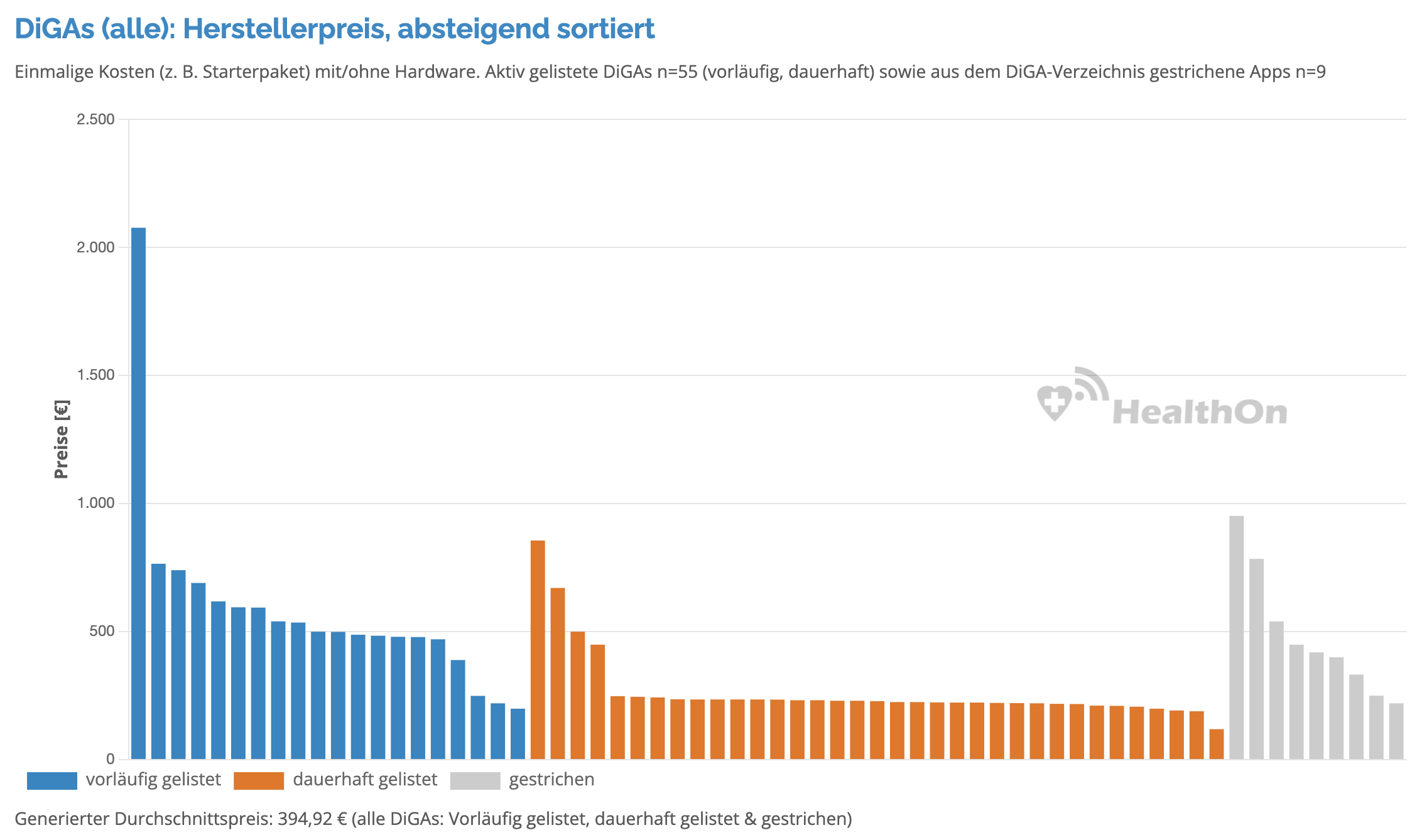

Let's start by looking at reimbursement prices. This overview from HealthOn (they have a convenient DiGA dashboard) includes all indications and sorts by preliminarly listing (blue) and permanent listing (orange).

Preliminarily listed DiGAs mostly cluster around the 500 € mark, with permanently listed ones closer to 230 €. These are the costs public insurances need to reimburse per perscription to the maker. They include VAT, so discount another 19% of those prices to get to the cash in the bank for startups making these products.

Whilst prices are subject to certain caps, the system allows companies to recuperate a significant share of their cost in year 1. As DiGAs are static monolithic products, their value decays over the years. They can not be adjusted to accommodate state of the art scientific work and face competition from newer products coming to market later. Initial sales are key.

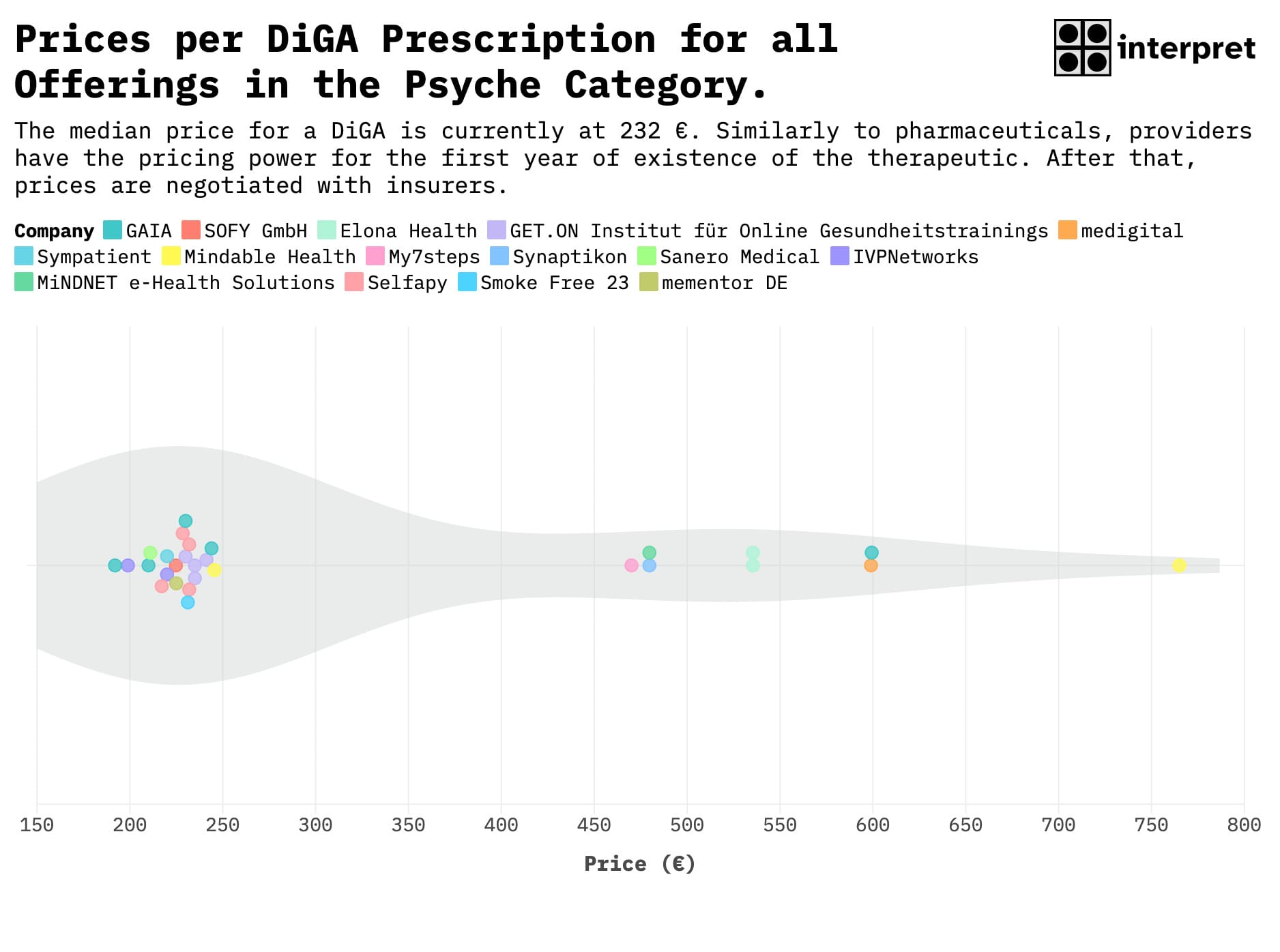

Focusing into our are of interest, the pricing distribution looks a bit different in mental health:

Most offerings cluster around the aforementioned 230 € mark for products that manage to prove their efficacy and get permanent approval.

Almost all outliers to the right-hand side of the graph are preliminarily approved products.

The most expensive mental health DiGA currently is made by Mindable Health and aims at social anxiety. It was preliminarily approved in December 2023. Preliminarly approval will end in September this year (the phase can be extended once by up to another year).

In their case, positive effects have been proven which will probably result in a permanent listing. It is interesting that the company managed to maintain the pricing for the first 2 years. Judging by the other DiGA Mindable Health provides, the price will come down in line with the median in the next few years.

Taking a look at base rates and offerings.

In my opinion, price is not the most important lever to pull, especially if you want to maintain relationships for future negotiations on your second or third DiGA (most companies offer multiple). What is way more interesting is the potential market size for each DiGA, as they need to be indication specific (meaning they can only be prescribed for predefined ICD-10 codes and need to be designed accordingly).

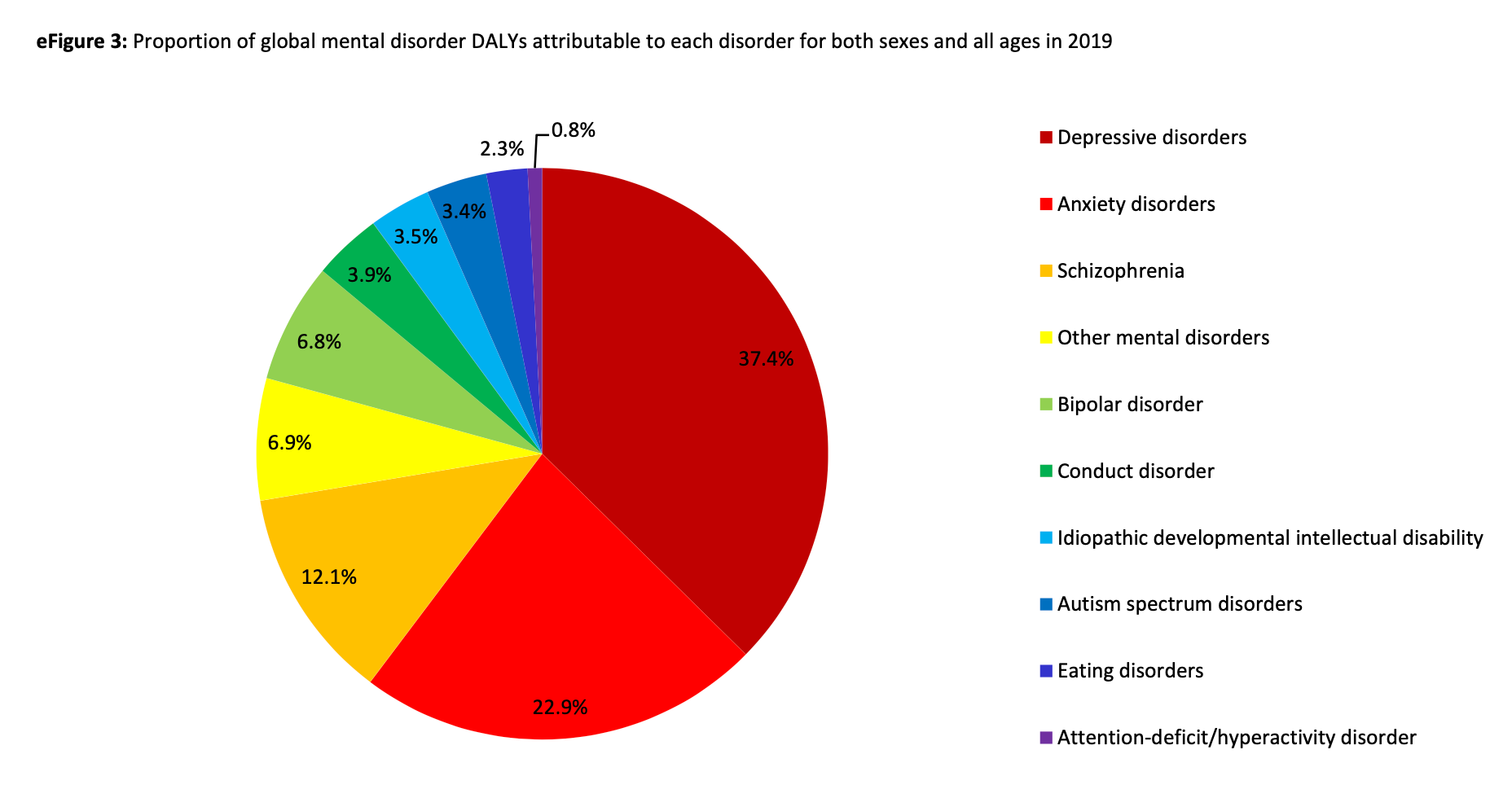

So, to get a better understanding of what revenues are possible over the life cycle of a DiGA, lets start of with the administrative prevalence of mental health disorders in Germany. Data on all indications is scarce and there are no epidemiological surveys from recent years across all indications. I ended up using the Global Burden of Disease study results from 2019 as it sums up the top disorders reducing life span in DALYs (disability adjusted life years):

Using DALYs to measure the severity of disorders we get a good starting point for the "important" diagnoses. Working on these disorders is arguably most impactful as those that suffer from them experience the most drastic reduction in healthy life span.

Note: For further observations, I will omit intellectual disabilities as they potentially arent elligable for DiGA due to their permanence and severity. The BfArM has no clear guideline here though.

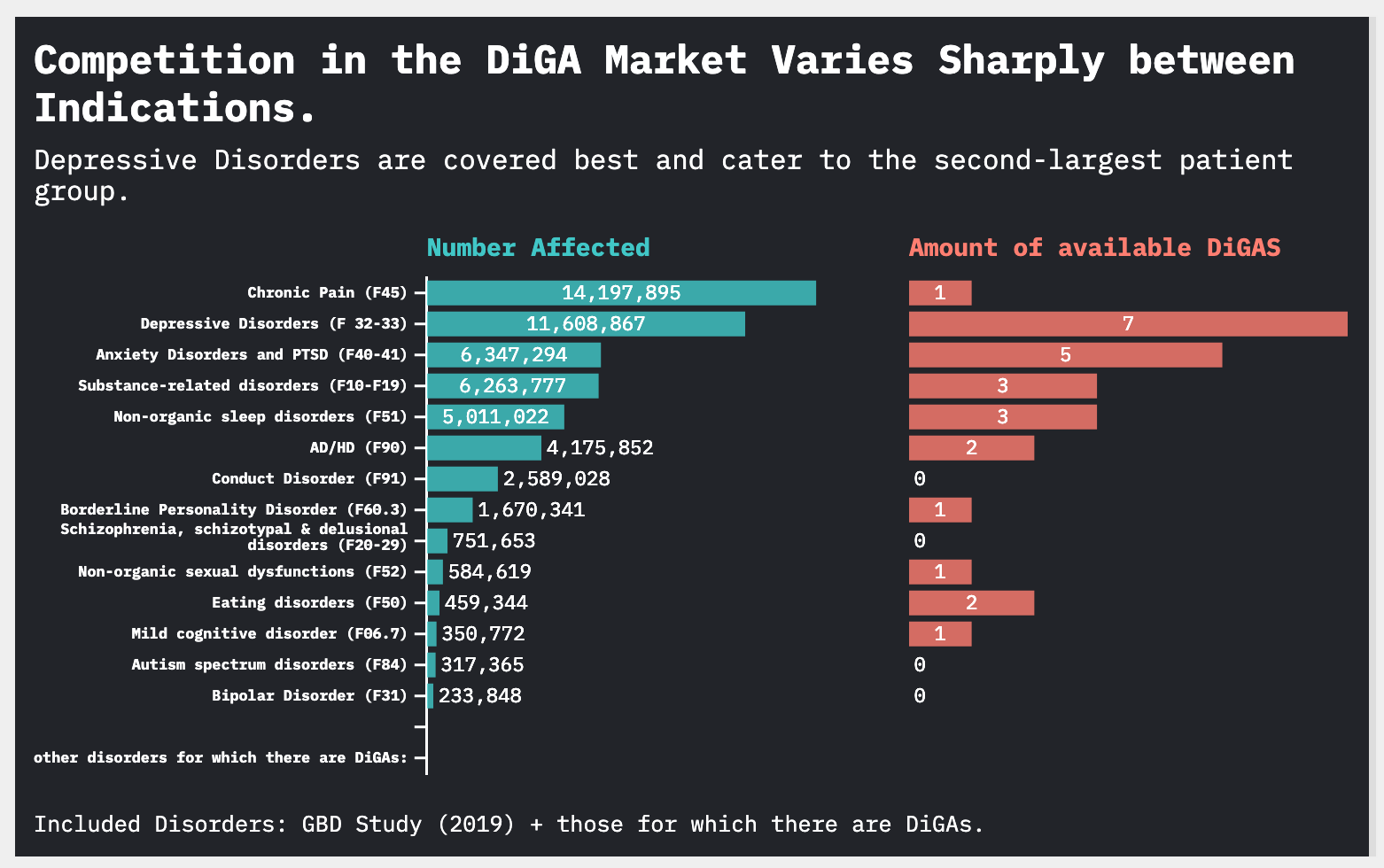

Now lets compare the prevalence of those disorders in Germany to the amount of DiGAs in each space.

Using population numbers from 03/2025, here are the results:

Note: Keep in mind that I needed to combine prevalence rates from over half a dozen sources. That definitely introduces some noise.

Comparing the number of affected against the offerings of DiGAs, we see irregular patterns. (It has to be noted though that not all of these indications are equally well treated with behavioral therapy interventions, wich DiGAs would count towards).

So here are my main observations:

- Chronic pain is the most underserved market. One single offering (HelloBetter Chronische Schmerzen) for an issue affecting around 17% of Germany population that is highly diverse in itself, there is definitely opportunity for another product (especially since HelloBetter has already proven the efficacy of their program).

- The total amount of patients reached by DiGAs for eating disorders is the last out of any with an existing offering. With 2 companies competing, there is roughly 229,672 patients per product. For most other indications we are looking at well over 1M potential patients.

- There are no DiGAs for the more severe of the disorders. This makes sense as DiGAs are not viable for any indication. The BfArM has no clear rule on which codes are elligable or not but the rules excluded severe disorders. Mild cases might still benefit.

Financially viable indications: plenty of gaps in the market.

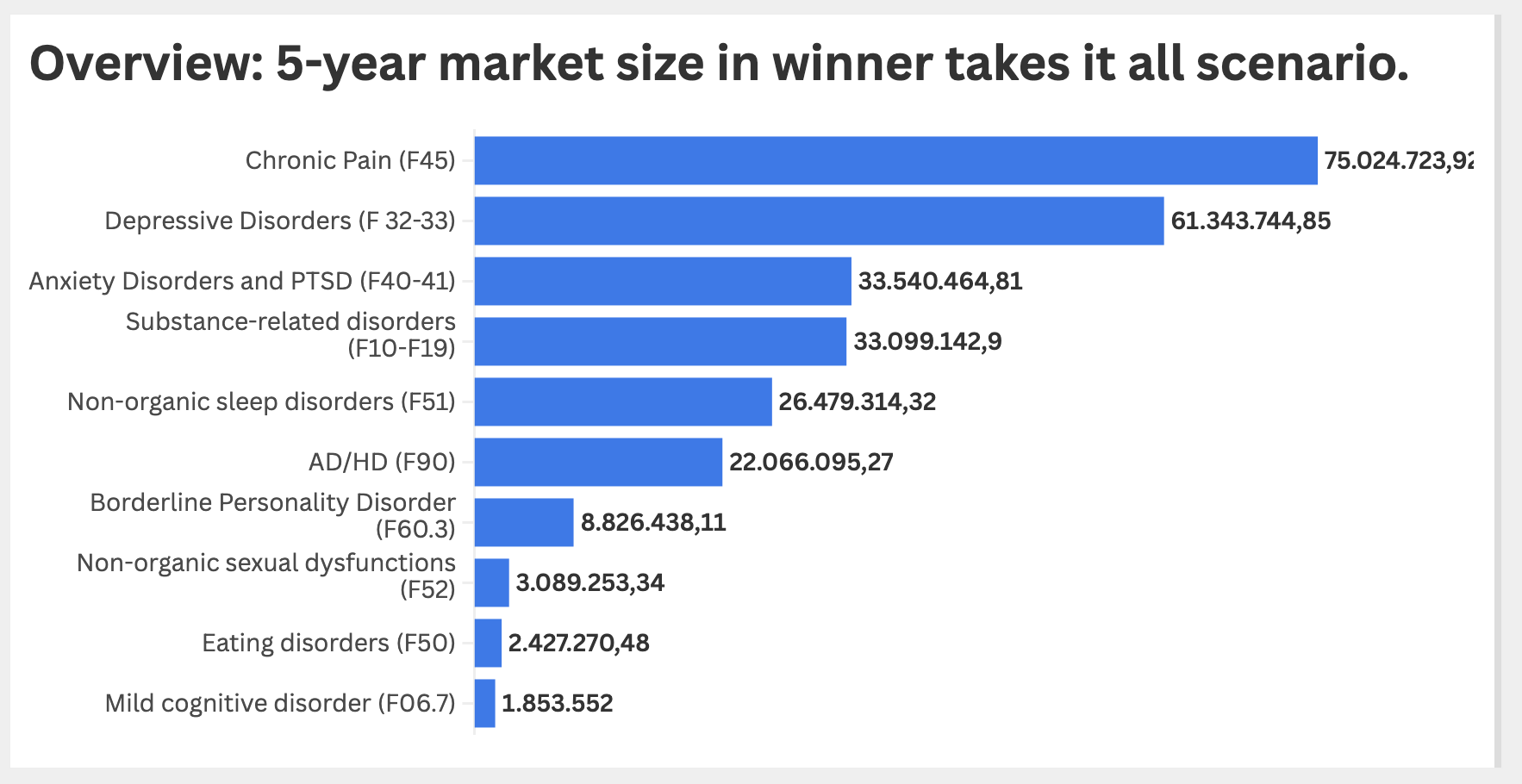

From here it is relatively easy (future Friederich realized that it was not at all, in fact, easy) to guestimate the potential revenue for each market. As the numbers of affected were calculated using 12m-prevalences (mostly), and DiGAs can be prescribed repeatedly, I will calculate the following way:

No. of people diagnosed (reachable) * price (500€ for year 1, 232€ for year 2-4) * 5 years *discount factor (different losses along the way delivery chain)

It is a bit more complicated than that, read through the end if you want a more detailed look! I will only go into detail on that discount factor right now:

According to the DiGA report, between Oktober 2023 and September 2024, 375,00 DiGA-codes were redemed. This is a growth rate of 80% comparing to the year before. No numbers are mentioned for Mental Health prescriptions specifically. As they make up roughly 50% of all DiGAs, I will guess that roughly 187,500 codes were given out for mental health.

The current range of Mental Health DiGAs adresses a market of slightly over 50M "patients". This number doesn't account for comorbidities, but one patient could be prescribed multiple DiGAs, so I will continue with that number.

In year 4 of the DiGA, roughly 0,375% of the total market were addressed (50M/187.5K). I will use this number as the discount factor. Realistically, it will grow double digits the 5-year projection I am making, but I am keeping it constant for simplicity sake.

Important note: The market sizes are based on the total revenue achievable in for each indication. For the F32-33 codes, you would need to devide that number by 7 "already", assuming an equal share amongst all currently available apps. For any indication with multiple offerings, it is really difficult to estimate the share for each player.

Comparing those numbers against a very rough estimate of the total cost to bring a diga to market, giving a rough idea of viablity. So let's look at the most and least attractive markets first.

With 2 competitors already, eating disorders are the least financially promising indication. There is already one offering for MCD, not leaving any space really for a second player.

Why? Assuming a GTM Cost of 800k€ and another 200k € for 5 years of operation (at least), there is simply not enough space in this indication for two profitable offerings.

Chronic pain is really the hidden star. There is only one DiGA for that space currently but it has the highest revenue potential. So this will be my answer to the thrid question: Go into chronic pain management DiGAs.

Anxiety disorders are surprisingly weak from a fiancial standpoint. This might be due to the fact that many phobic disorders don't need treatment and don't get diagnosed as often. This impacts the market size calculation.

All in all, I think my estimates are rather conservative, mainly because they don't assume any growth in prescriptions (where there was 80% growth between year 3 and 4). Still, the numbers are an indicate which areas are relatively more and less attractive. Also, in the last reported quarter (Q4) 2024, new prescriptions stagnated.

I will be the first to say that my assumptions are bad. There is a lot to critique here and I will happily take suggestions to improve the math.

For now, here is what I completely ignored in my calculations:

- I do not look into how viable digital interventions for the given indications are at all.

- There are plenty important disorders I didn't cover here.

- I didn't take into account if there are already dominant players in individual indications or how well those existing ones are actually doing (certainly, there is a lot of variation).

- I didn't consider Z-categories of diagnoses. There is one Application for Stress and Burnout by BetterHelp for example. The economics of that might be very interesting too.

In conclusion

I would love to hear from someone with insider knowledege: how far off am I? Please reach out!

For now, we basically only looked at the existing market structure and offerings. The advantage is that we only look at indications were other DiGAs already proved that they have therapeutic value. Within that space, chronic pain is the most interesting candidate. Outside of the existing offering, personality disorders might be really interesting, especially considering the potential benefits in re-prescribing the same DiGA for multiple times potentially.

And last but not least: the point is not to find the disease where you can make the most money and hit the highest margins. The point is to point out where investment is a no-brainer and where you have a chance that your startup will survive long term and build truly benefical products. Impact takes time and money.

P.S. To complete this post, I will share a clean sheet with all the data and individual sources for you to check through my calculations by yourself in next week's edition. Just need a bit more time to clean it up! Fundamentally, nothing should change though.

Alright, that's it for the week!

Best

Friederich

P.S. Know anyone who might be interested in reading this? Forward this email to them!