Mental Health Market Map

Providing an overview of GTM paths to help you decide where to take your idea.

Going from idea to product is never trivial. But with a regulated market like digital mental healthcare, the options are broader than with a simple run-of-the-mill SaaS business. Here is an overview of the main paths you can take from idea to serving users or patients:

DiGAs

The obvious play.

Digital Health Applications (DiGAs) are prescription-based digital therapies available in Germany. With nearly five years on the market, there are now 59 approved DiGAs addressing a broad spectrum of medical conditions.

Of these, 27 are dedicated to mental health, prescribable by physicians and psychotherapists, and fully covered by statutory health insurance. Till date, well over a million DiGAs have been prescribed.

But think twice, please. You might see the numbers and go "oh wow that's lots of offerings, there surely is space for one additional one or two". Whilst I would agree (as I outlined here, I see potential for certain indications), currently there are two really dominant players in the market: HelloBetter and Selfapy. They gobble up a majority of the market and are serial DiGA makers. It will be hard to match their expertise and relationships/network. I say all this because bringing a new DiGA to market can be a million Euro bet, taking years to test with real users.

But then again, if you make it through the perils of regulation, you can make significantly higher revenue per users comparing to D2C offerings. In the mental health space, median prescription price is €232 currently, for a 90-day program. If you can get doctors to keep prescribing your product (aka if it makes sense to use long term) you are printing money. Here is a full overview of the price range of existing products:

Two DiGAs that stand out:

- Mindable Soziale Phobie (social anxiety). This is currently the most expensive mental health DiGA at €765 per prescription. This is due to the fact that providers can control the reimbursement amount in the first year of listing in the DiGA registry. Anxiety disorders are amongst the prevalent in Germany, after depression and chronic (psychosomatic) pain, so I am sure there is a sizable chunk of cash made here.

- HelloBetter Chronische Schmerzen (chronic pain). This is the only app in the segment currently. Again, read my previous piece on the DiGA market to see why I see an opportunity to compete here.

Reimbursable Prevention Apps

DiGA light.

Digital prevention reimbursable apps are health apps approved and partially or fully reimbursed by statutory health insurance providers. These apps focus on preventive healthcare, helping users avoid illness, reduce risk factors, or promote general well-being. Crucially, you don't need a prescription from a doctor to get them reimbursed!

They must fall into one of the four categories defined by the GKV:

- movement habits

- nutrition

- stress- and resource management

- consumption of addictive substances

I wrote a full introduction recently.

The good stuff: prevention apps don't require a prescription, they cost significantly less than a DiGA to bring to market, and they allow for customization in the product. DiGAs are effectively fully manualized where these leave room for dynamic adjustments to the needs of the individual user.

Not all is rosy and sunshine, though: Approval cycles are shorter (approval is always limited to 3 years) and users potentially need to pay out of pocket for the product before getting a reimbursement. Taken together with the fact that you are addressing people not fully sick yet and there is no doctor telling you to use one of these products to heal, it is certainly more difficult to engage users.

Unfortunately, there is no central registry for apps like these. Each insurer cuts individual deals with app makers to reimburse their product.

D2C

The hard consumer play.

You will be forced to validate your product with individual humans, no using big names of insurers or relying on doctors to effectively sell your product for you. The product will need to stand for itself, meaning people will need to find it so good that some of them start paying.

I see the biggest advantage in shorter iteration cycles, direct user feedback and lower regulatory burden. Yes, you should get all the relevant certifications eventually, but you can start getting beta testers (who should be aware of the early stage of your product!) to give input on functionality and catch up on regulation in parallel.

Two examples from the space:

- Aury. Currently in beta, available over WhatsApp, their AI chatbot is supposed to act as a counselor/therapist and proactively guide you through working on your problems.

- Me App. A wellbeing management app based in psychoanalytic psychotherapy designed to educate about mechanisms of the psyche, track wellbeing, and help grow into a more satisfied person.

Employer Solutions

Why sell to an individual, if you can get an entire org at once? Companies are interested in mental health solutions for obvious reasons: monitoring employee performance, offering perks, being "people first".

In the end, the argument is often a financial one: you save money or make more by taking care of your employees. The range is broad, from fancy HR solution to true company-level product. Many companies aim at becoming HR all-rounders, but specialization (e.g. on leadership, or crisis interventions) can be a starting point too.

Two very different examples:

- Nilo Health. Traditional employee wellbeing, but fully digital. The core of the offering are sessions with Psychologists and leadership development.

- SoulX. A bit of a misfit in this category at first sight because it is aimed at schools. But fundamentally it is similar to an employer solution: help members of the organization live a happier life by dealing with life and work (or education) challenges.

B2B Infra

EHRs and more.

The current topic of debate in this segment are AI scribes, for therapy session documentation and diagnostics. In general, technology is pitched as an unlock for therapists to do more of the work they really want to do. The space is really vast and relies on deep knowledge of processes and pain points it is never as easy as just making some tech ready for healthcare. Implementation is the more complex issue to solve.

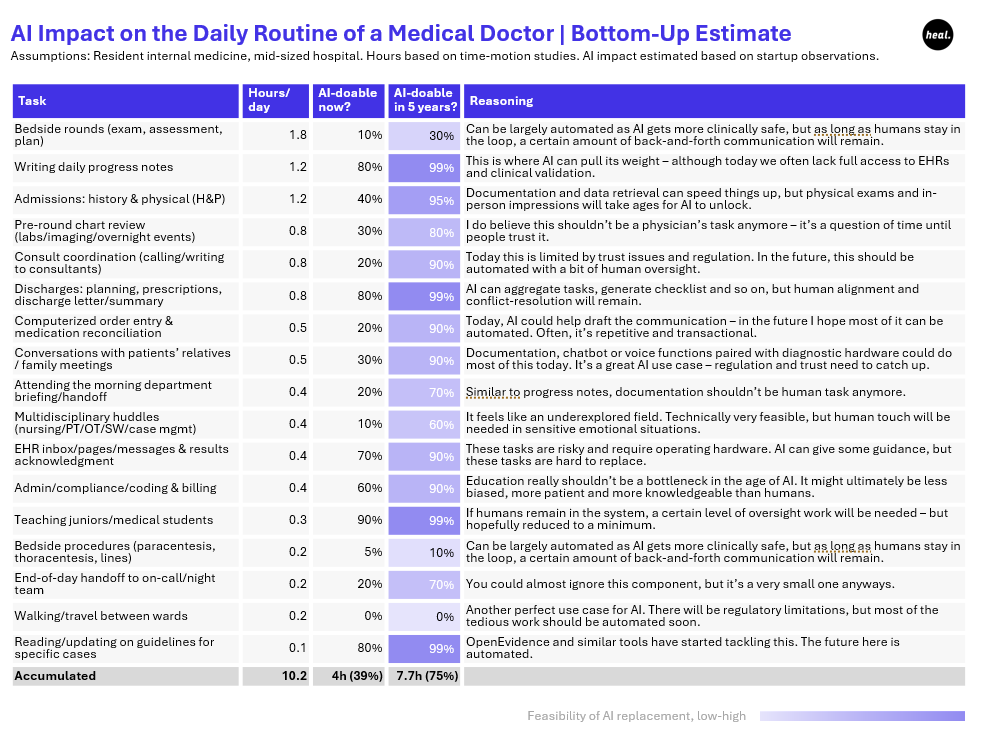

I found this graphic by Dr. Lucas Mittelmeier at heal capital from recent newsletter quite interesting:

He argues the medical doctor augmentation case as a mid-term outcome to invest into (he's a VC). Why not try the same for Psychologists?

Depending on where you look, there are very different products in the space working towards exactly that:

- Insight.out. The company digitalizes psychometric testing.

- Recovery Cat. Their app allows patients to track symptoms and other health markers. Therapists can customize repeating questionnaires to fit the individual patient's needs and fill in the gaps of data collection in-between patient interactions.

- Corti.ai. The company is building the "backend for every healthcare app". They offer specialized AI models for transcription, documentation, and diagnostics purposes.

Adjacent services

Companies in this space automate services which qualify products to enter the market.

All companies that provide specialized services, e.g. DiGA agencies specialized on bringing a product to market. Just google DiGA agency and get swamped by a looong list of professionals trying to sell you their expertise.

Another big area is regulatory advisory. Most founders either have clinical experience or come into their companies out of some form of business education. Neither know how to navigate ISO certifications, security standards and approval applications by themselves.

So where to start?

Building a B2B solution, the choices are pretty limited. Either way, you will need significant startup capital to develop a solution functional (and secure enough) to find customers. It is not uncommon for such startups to grow out of partnerships with clinics, usually the employers of one of the founders. Meaning: If you build for hospitals, get yourself a doctor and their institution to back you!

Going B2C, the choice of positioning is more complex. Regulated products are not inherently bad, but the space is already competitive, and you would rely on true innovation to develop what boils down to more effective therapy manuals. The tech side is rather easy though, you just take said manual and digitize it into a lesson format. And you require lots of money. The biggest issue is that your first DiGA is a make-or-break moment. If it fails to show clinical efficacy, like this Selfapy DiGA did, you can say bye-bye to your company. Selfapy does it to capture more fringe or less obvious markets. They can afford to fail once or twice though, because of their other successful DiGAs.

If your solution is more creative or simply not aimed only at a very specific diagnosis, product paths with lower regulation make more sense. You will need to try out and have many more failed attempts. But in contrast to a DiGA, you can start earning and getting user feedback before costly approval. I would argue that people deciding to pay for a mental health app is a strong signal of (sub)clinical benefit. The chances of a successful clinical trial increase, if you can pretest a few versions of your app.

To be clear, this section is only about the starting point. An agency could grow into a product company, a D2C offering could still seek DiGA approval. The right path for your company might be non-linear.

You can always reach out to me vial email and share your ideas. Curious about your take!

Interested in discovering more companies within the niche you found for your idea? I will soon release a database of mental health startups. Sign up for the newsletter to find out first.